In 2016, Fed Chairman Janet Yellen started to increase interest rates. Doomsayers said that REITs will be affect by the rising borrowing cost. Some even said that REITs will tank a further 20% by 2020 while most REITs are trading at/near 52wk low in 2018. Well what do you know, Powell had signaled a slow down in rising rates. This further shows that you can't predict or time the market. Hence REITs has been pushing towards new highs in January 2019.

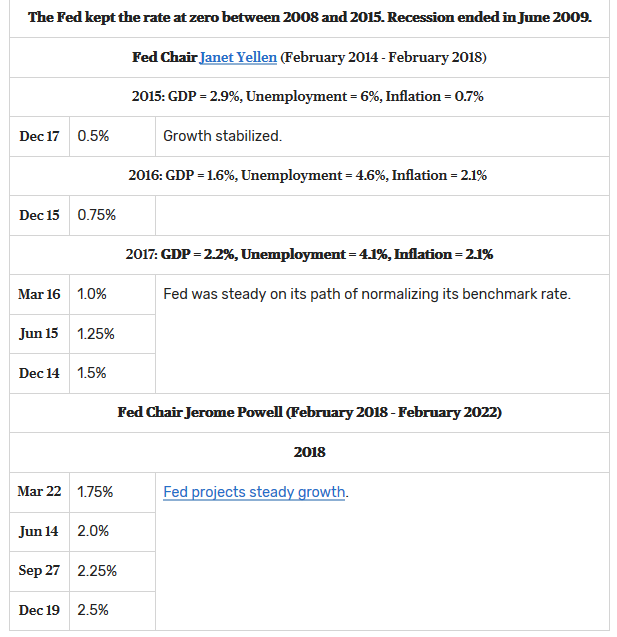

Between Dec 2015 to Dec 2018, the Fed had increased interest rate by 2%. Did the cost of borrowings affected the REITs as most had feared that led to the sell down in 2015? I decided to take a look at the REITs that I own as well as the more popular ones.

It seem that those that have a huge jump in cost of borrowings are those that are aggressively executing M&A despite the rising rates., especially the Mapletree family. If memory serve me right, CCT, Areit, MLT and MINT did some aggressive M&A during these period. Although the increase looks big in terms of percentage, the cost is still manageable (e.g 48 basis points increase for MCT) and most are still below 3%, More importantly, their interest cover is healthy.

Will you still invest it those REITs with increased finance cost? even if they are overvalued like MINT,CCT and Areit? Or it is okay as long as the higher finance cost resulted in higher DPU? From the table below we can see that Mapletree's REITs, with their higher finance cost, they manage to grow their DPU over the pass 3 years compare to the rest, even better than Areit.

| |

| * Base on Last 12 Months |

From this exercise, Mapletree really impress me with their growth. MLT might be a better choice than FLT and MINT compare to Areit. Most Reits' borrowing cost has actually came down instead of flying northwards.

0 comments:

Post a Comment