Sembcorp Industry(SCI) has been hammer down since 2016. Main Business is with the Utilities and Marine sector. Oil has plunged to below US$40 in 2016, bump up to US$74 and now back to US$40ish. and so has the share price. The share price is now $2.51 compare to 2016 low of $2.56. Yes, it is even lower now with a new low of $2.43.

In terms of Price to book value is at 0.64x, at this price you get the marine segment for free. The book value of the marine segment is 31% of SCI's. This a bargain!

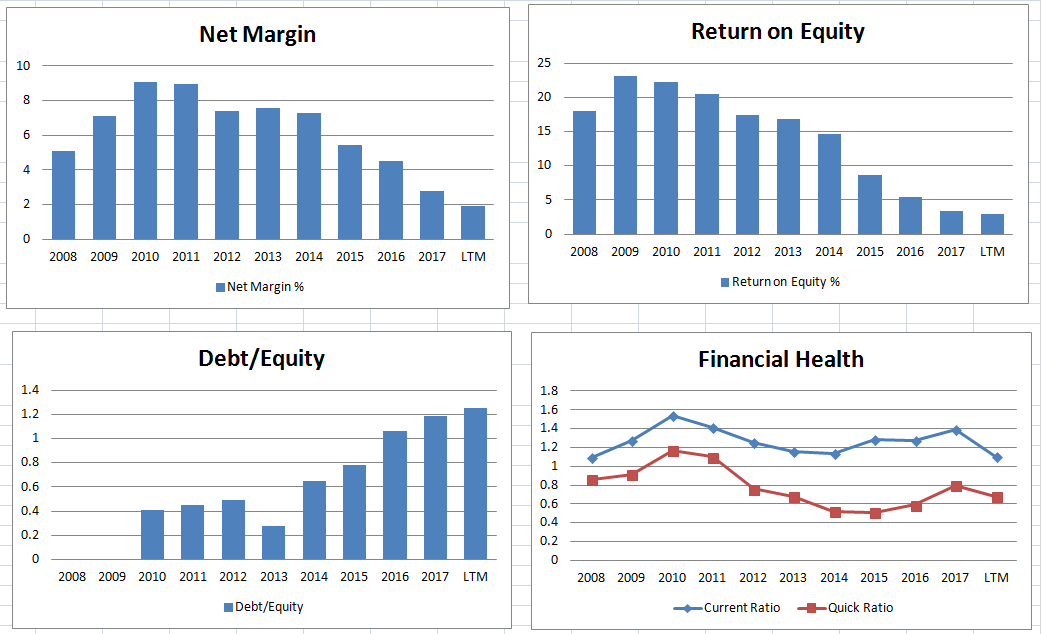

However SCI results are still worsening, Net margin are getting pathetic. Debt are increasing since 2010. Interest cover is at 2x but current ratio is at 1.1x with quick ratio at 0.68x. Hence this could further dampen the stock price, especially with the current economic outlook. Oil is still being heavily manipulated. After 3 long years, Oil prices never recovered to near US$100.

Will SCI go bust? It is owned by Temasek Holdings (Private) Limited with 49% stake. Anything can happned doh. I find cyclical stock are hard to invest in. Base on book value, it seem to be a bargain. Well you don't get to buy at bargain unless things are bad right?

The writer of this blog is really very professional. Every single line of this article is well written. New use of vocabulary is a great effort. At the same time tense, indirect speech was also sued in good manner. peer to peer lending sipp

ReplyDelete