I bought Tat Seng Packaging(TSP) last year before I start writing this blog journal. Sometimes I re-read my own post to remind myself why I bought in the first place and not to panic. Hence I have been wanting to do a write up.

TSP business is very simple, producing packaging products such as corrugated paper boards, corrugated paper cartons, die-cut boxes, assembly cartons and heavy duty corrugated paper products. Customers are from sectors includes food and beverage

industry, electronics and electrical industry, plastic and metal

stamping industry, pharmaceutical and chemical industry as well as the

printing, publishers and converting industry.

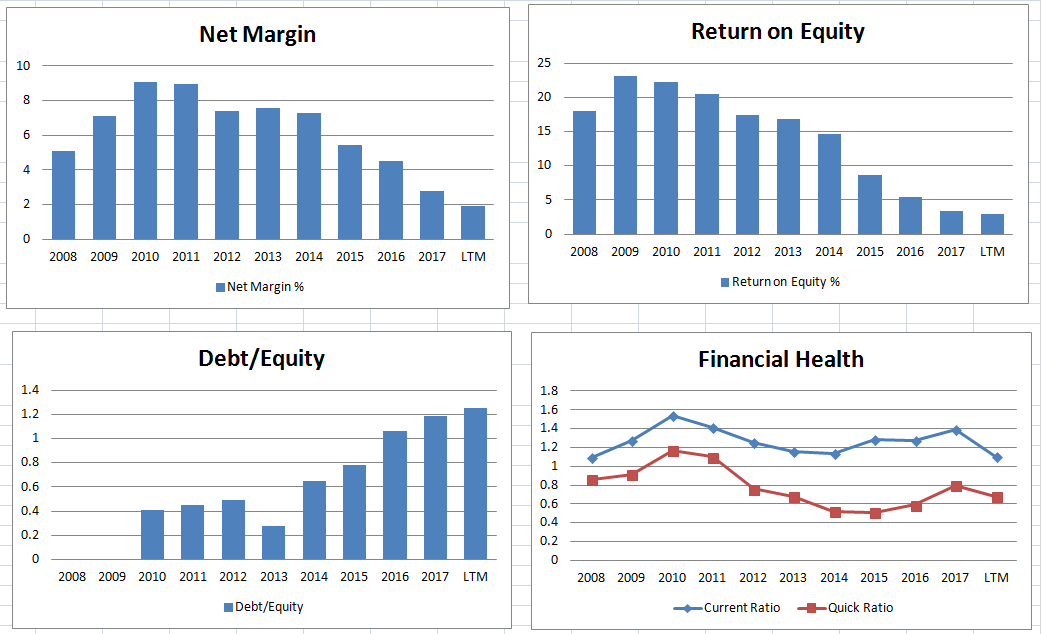

TSR is growing at an a impressive CAGR of 13.62% over the last 9 years. Net margin is growing as well which mean more profits and increasing dividend as EPS grows. ROE is at a record high of 20%. The standard FCF = Net profit - CAPEX, when calculated give a very bad picture. FCF drop drastically due to the cost require to build a new plant in Nantong. If we look at actual cash flow a company has in their disposal, Actual FCF = Net profit - CAPEX - Investing activities + non-cash items + Borrowings during the fiscal year. In 2017, we can see an increase in debt which helps to boost the cash flow. However Debt/Equity is near 52%, which is still low. Interest Cover is at 30x.

Business Moat

I would say TSP no business moat for the business, there are more than 5000 similar companies in china. Therefore it really up to how the management manage the business. Cost management, efficiency, productivity such as being one of the few that operate 24 hrs , the capacity to increase production during big event like 11.11 singles day sale. (Your can read more from AGM 2017 post) Having private china investor helps too in terms of business relations.

Growth Factor

Growth in the sector will be closely related to the eCommerce sector. This sector in South East Asia alone will exceed US$100billion by 2025 from US$32billion. (Source: The edge Singapore issue 862, Read: Southeast Asia's Internet economy to exceed US$240 bil by 2025: Google-Temasek report)

Business Risk

Business risk comes from higher raw material cost if they are unable to pass on to their customers (they are able to, to some extend mention during the AGM 2017). Slow down in economy, maybe due to the trade war. However all these are short term risk, with current and quick ratio are above one, the business has the financial strength to weather through.

Cash Cover Conversation Cycle

Receivable over Sales seem high, at around 40% but the Cash Cover Conversation Cycle (CCC) was below 0. This means that the company take a longer time to pay out than their customer to pay them which is good. However the LTM 2018 see CCC spike back up to 2008/2009 levels. This show the customers need more time to pay up, also show that they have become more conservative in keeping their cash flows. In this case, TSP also pay out faster than usual.

Trading at S$0.59 with a NAV of $0.79, PB ratio is at 0.75 and 4x PE. Dividend yield is at 5%. The current price seem reasonable.Vested at S$0.72 :(

Read More